income tax rates 2022 ireland

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 12012 21295 2.

2022 Corporate Tax Rates In Europe Tax Foundation

Single and widowed person.

. Effective Income Tax Rates in Ireland 1997-2022. Ireland has a bracketed income tax system with two income tax brackets ranging from a low. Payments and income exempt from USC.

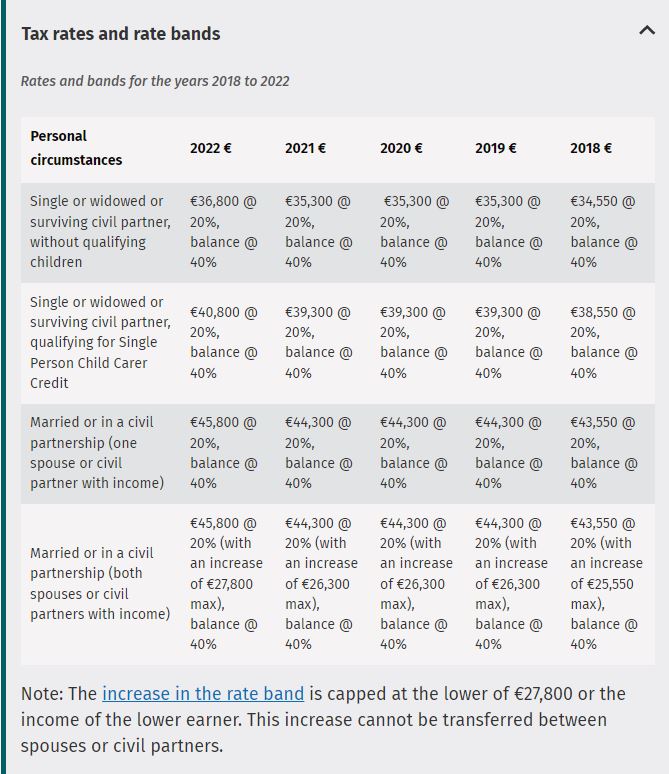

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. Rate bands and tax reliefs for the tax year 2022 and. Tax Rates in Ireland for 2022.

This page tells users how Income Tax is calculated using tax credits and rate bands. The Personal Income Tax Rate in Ireland stands at 48 percent. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your.

Reduced rates of USC. The percentage that you pay depends on the amount of your income. What will the provisions contained in Budget 2022 mean for you.

2022 EUR Tax at 20. Get a quote today. Total of income tax including USC levies and PRSI as a total income.

2129501 70044 45. This page shows the tables that show the various tax band and rates together with tax reliefs for the current year and previous four years. Tax Bracket yearly earnings Tax Rate 0 - 36400.

This guide is also available in Welsh Cymraeg. Tax on this income. 0 12012 05.

Standard rates and thresholds of USC. Taxable income Tax rate. Your 2021 Tax Bracket to See Whats Been Adjusted.

Based on Budget 2022 we calculated effective tax rates for a single person a single income pair and a two-earner couple. The personal income tax system in Ireland is a progressive tax system. Personal income tax rates changed At 20 first At 40 Single person increased 36800 Balance Married couplecivil partnership one income increased 45800 Balance.

Get a quote today. We help landlords across Ireland file their rental income tax return. Capital gains rate.

There are seven federal income tax rates in 2022. Summary of USC Rates in 2022. Personal Income Tax Rate in Ireland averaged 4565 percent from 1995 until 2020 reaching an all time high of 48 percent in.

You will need to understand how tax credits and rate bands work. Discover Helpful Information and Resources on Taxes From AARP. We help landlords across Ireland file their rental income tax return.

Resident companies are taxable in Ireland on their worldwide profits including gains. Ad Compare Your 2022 Tax Bracket vs. Non-resident companies are subject to Irish.

Income up to 36800. Table 1 presents the results of this analysis. Standard rates and thresholds of USC for 2022.

Other rates of USC. 31125 plus 37 cents for each 1 over. Ireland Annual Salary After Tax Calculator 2022.

Personal income tax rates. Ad A high quality low cost tax return service for Irish landlords. The current tax year is from 6 April 2022 to 5 April 2023.

To give you a clearer picture of the taxes youll pay on earnings we collected the 2022 rates for Irish income tax and contributions for the USC and PRSI in. Working holiday maker tax rates 202223. Self -employed workers with an income over.

Ad A high quality low cost tax return service for Irish landlords. Use our interactive calculator to help you estimate your tax position for the year ahead. This is known as the standard rate of tax and.

The first part of your income up to a certain amount is taxed at 20.

2022 Tax Inflation Adjustments Released By Irs

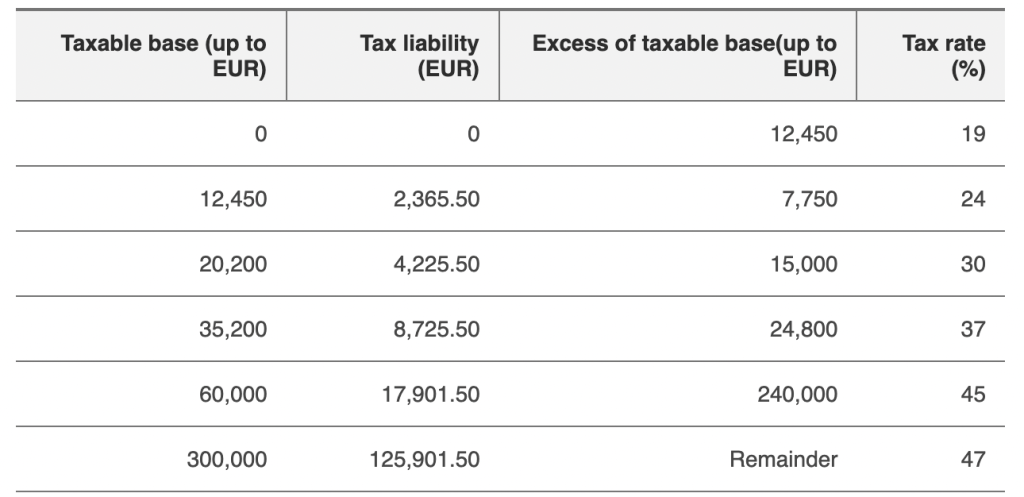

How To Pay Tax In Spain And What Is The Tax Free Allowance

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Paying Tax In Ireland What You Need To Know

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

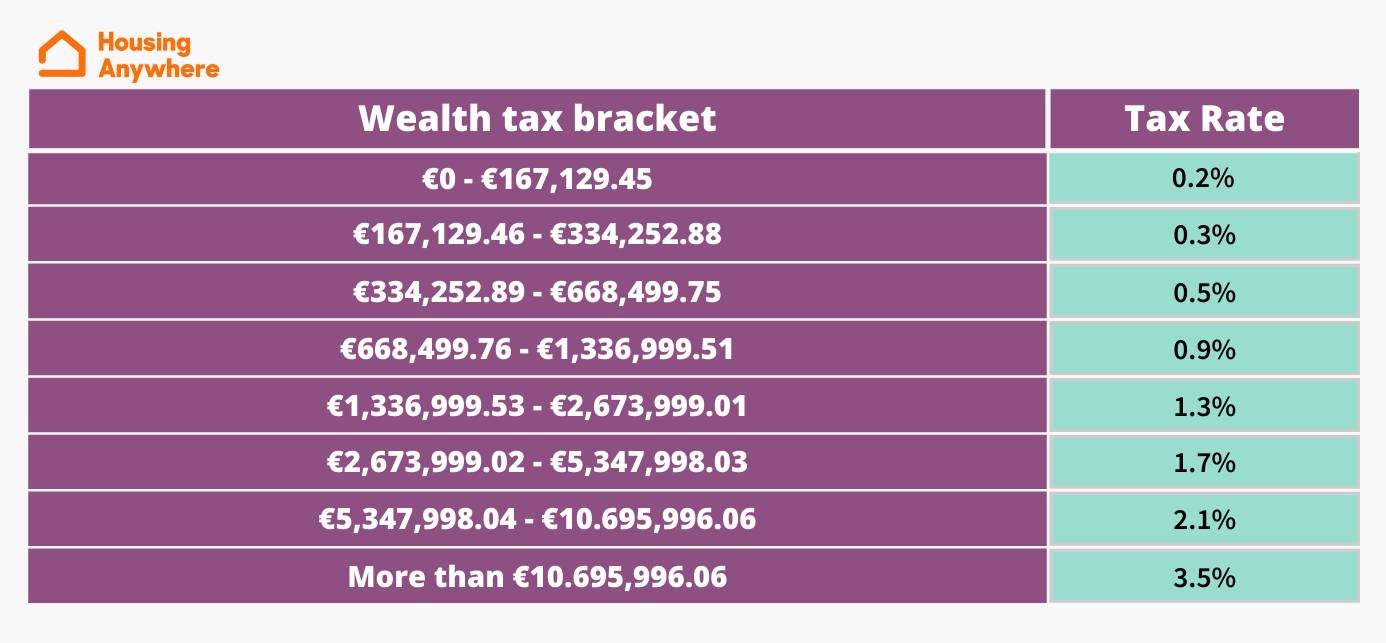

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Effective Tax Rates After Budget 2022 And Why Ireland Remains A Low Tax Country Social Justice Ireland

Population Change In U S States Canadian Maps On The Web In 2022 Canadian Provinces Map States

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Prachi Ca I Will File Indian And Candian Corporate And Personal Tax Returns For 20 On Fiverr Com Tax Income Tax Tax Return

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

2022 23 Uk Income Tax And National Insurance Rates

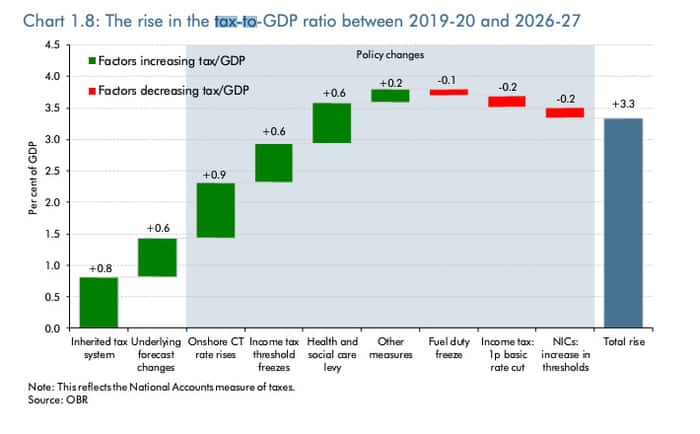

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

2022 Carbon Tax Rates In Europe European Countries With A Carbon Tax

2022 Tax Inflation Adjustments Released By Irs

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Paying Tax In Ireland What You Need To Know

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca